News and Insights

Ionic Insights: The Installed Business Jet Fleet in Australia (August 2022)

In this, our fifth edition of Ionic Insights we focus on Australia. We analyse the size, make-up and age of the installed fleet, whilst simultaneously investigating the most numerous aircraft registries and base locations.

Analysis

Being the sixth largest country in the world by land mass, Australia has a relatively large installed fleet of 226 aircraft.

Despite having an economy only one tenth of the size and a population one fiftieth of that of its largest trading partner, China, the installed fleet is only 7% smaller.

The presence of many large domestic and multinational corporations, particularly in the mining, agricultural and financial services sectors, drives the ownership of heavy, ultra-long-range aircraft at the top end. It is not surprising therefore that two-thirds of these aircraft are based in the financial centres of Sydney and Melbourne; whilst over a third of all aircraft are based in Sydney (Australia’s most populous city) and New South Wales alone.

The dominant aircraft category is the Light/Very-Light Jet segment – which represents around two thirds of the overall market. Cessna is the largest OEM by fleet size with approximately 37% of the fleet; Bombardier (including Learjet) is in second with 35%.

The prevalence of large numbers of Light/Very-Light aircraft (and their resultant small deal sizes) means that the opportunities for attracting international, cross-border financing are comparatively limited. However, the strong overall economy, English common law-based legal system and the presence of independent aircraft management companies (ExecuJet Australia being the largest) are strong positives for those financing larger aircraft.

The average age of the fleet is twenty-two years; and whilst nearly nine out of every ten aircraft are registered in Australia (VH-), the remainder are registered in the U.S., with a single aircraft being registered in the Cayman Islands (VP-C).

This analysis is summarised in the following slide:

The Installed Business Jet Fleet in Australia, August 2022.

Ionic Insights: The Installed Business Jet Fleet in the United Kingdom (June 2022)

To coincide with the return of this month’s Farnborough International Airshow, this edition of Ionic Insights focuses on the United Kingdom. We analyse the size, make-up and age of the installed fleet, whilst simultaneously investigating the most numerous aircraft operators, registries and base locations.

Analysis

With an installed fleet of 209 aircraft, the UK is second only to Germany in Europe in terms of numbers of aircraft and is broadly similar in scale to that of France. Bombardier is the largest OEM by fleet size (28%), with Cessna (22%) and Dassault (15%) being not far behind.

The dominant aircraft categories are the Mid/Super-Midsize and Ultra-Long-Range segments – each boasting around a third of overall market share. In addition, Light/Very-Light jets make up approximately one quarter of the fleet.

Overall fleet size and composition is heavily influenced by the presence of an extensive commercial airline network plus the relatively compact geography of the UK and Western Europe; the presence of a large UHNW community and many multinational corporations drives ownership of ultra-long-range aircraft at the top end.

Not surprisingly, nearly half of all aircraft are based in the London area; with Jet Concierge, Luxaviation UK (formerly LEA), TAG, GAMA and Catreus being the largest operators.

Over 50% of aircraft are registered domestically in the UK (G-), with the Isle of Man (M-), U.S. (N) and the Channel Islands (2-) being the most popular registries thereafter.

This analysis is summarised in the following slide:

Figure: The Installed Business Jet Fleet in the United Kingdom

Upcoming Events

Ionic Aviation will be attending the Farnborough Airshow from 18 – 20 July.

Ionic Aviation to attend EBACE 2022

Ionic Aviation will be attending the European Business Aviation Convention and Exhibition (‘EBACE’) in Geneva, Switzerland, from 23-25 May 2022.

EBACE is Europe’s premier gathering of business aviation professionals and attracts aircraft owners, original equipment manufacturers, advisers and other industry participants from all over the world.

Reach out to us directly if you are attending and would like to meet.

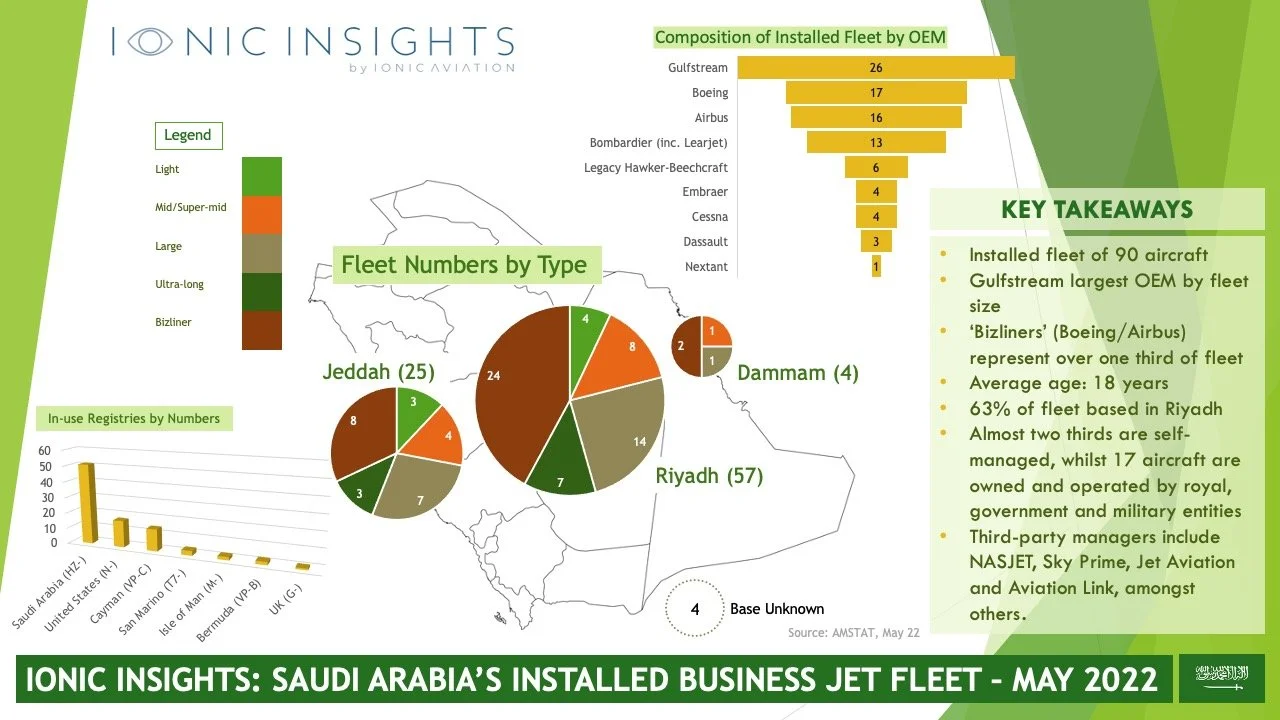

Ionic Insights: The Installed Business Jet Fleet in Saudi Arabia (May 2022)

In this third edition of Ionic Insights, our regular country by country spotlight on the global business aviation sector, we focus on the Kingdom of Saudi Arabia. We analyse the size, make-up and age of the installed fleet, whilst simultaneously investigating the most numerous aircraft registries and base locations.

Historically the Middle East’s largest business aviation market, the installed fleet in Saudi Arabia is now smaller than that of the UAE. This is down to several factors, but the continued relocation of many multinationals and ultra-high-net-worth individuals to the Emirates, plus the fallout from 2017’s Riyadh ‘Ritz-Carlton Prison’ episode are key.

Saudi Arabia has an installed fleet of 90 aircraft*, with Gulfstream being the largest OEM by fleet size (29% of the fleet). Perhaps unsurprisingly, corporate variants of commercial aircraft – notably ‘bizliners’ manufactured by Boeing and Airbus – represent over one third of the entire base. Almost two thirds of aircraft are based in Riyadh, the political and administrative capital.

In a challenge to those seeking to finance/refinance aircraft within the Kingdom, almost two thirds of aircraft are self-managed (no third-party operator involvement), 57% are registered locally in Saudi Arabia (HZ-), and a total of 17 aircraft are owned and operated by a variety of royal, government and military entities.

The key takeaways from this analysis are summarised in Figure 1 below.

If you found this information interesting, feel free to sign up to receive future editions direct to your Inbox via the pop-up notification on this website.

Figure 1: A summary of the installed fleet in Saudi Arabia. *Source: AMSTAT, May 22

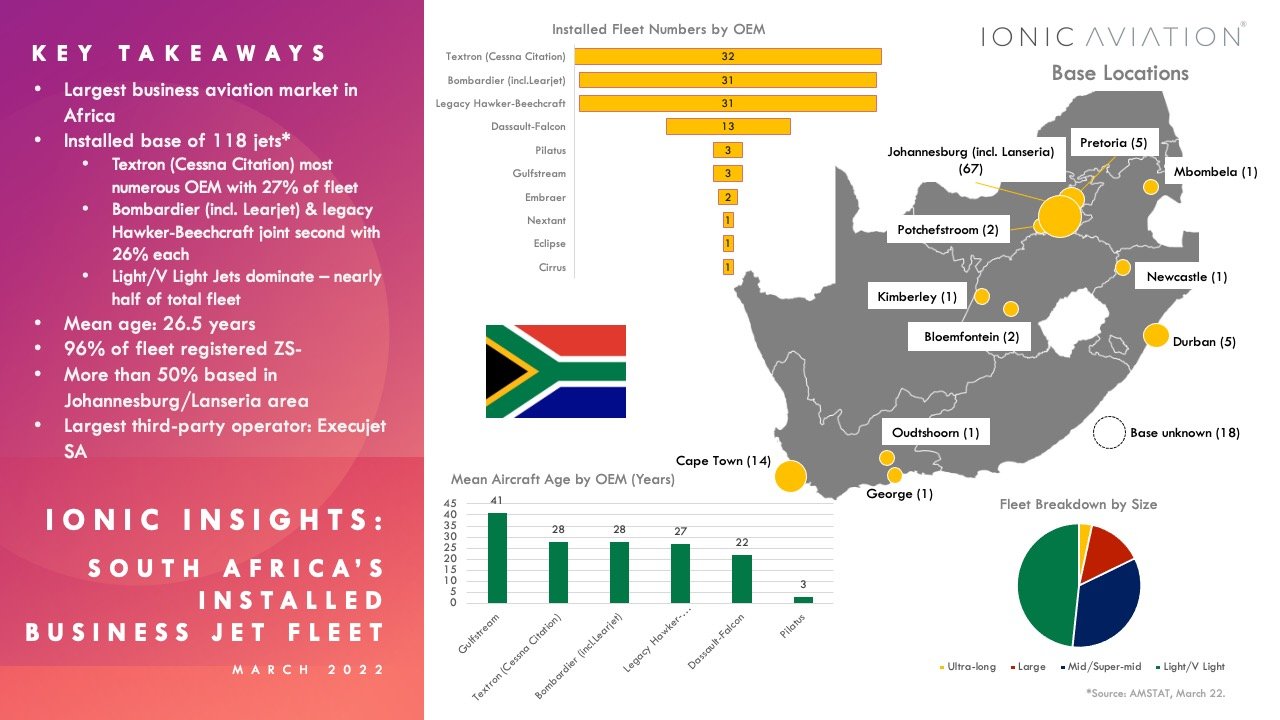

Ionic Insights: The Installed Business Jet Fleet in South Africa (March 2022)

Welcome to the second edition of Ionic Insights, our new and regular focus on the global business aviation sector.

Each Insight serves to provide financiers, investors, brokers and other interested parties an easily digestible snapshot of the installed business jet fleet within a specific country or region.

In this edition we focus on South Africa. We analyse the size, makeup and average age of the installed fleet, aircraft registries and base locations.

Whilst the size of the fleet is dwarfed by the number of helicopters and turboprops in operation – jets represent only one third the number of helicopters and approximately one half the number of turboprops – South Africa boasts more jets than any other market in Africa.

The market is biased towards the lighter, smaller end of the market; with the vast majority of such aircraft being self-managed. The national registry (ZS-) is almost entirely dominant. Whilst the mean age of the fleet is comparatively old at over twenty-six years, it is notable that less than 2% of that fleet is listed for sale – almost half the current global average.

I hope you find this Insight useful. Look out for future editions!

A summary of the installed business jet fleet in South Africa, March 2022.

Ionic Insights: The Installed Business Jet Fleet in Ukraine (January 2022)

Given the scale of the challenges faced by aviation over the past two years, the last thing the industry needs is war in Ukraine.

Whilst conflict remains unlikely, the ongoing rhetoric and build-up of military forces means that the potential for misunderstanding and mistakes is high. In addition to the obvious consequences for the people of Ukraine, there are significant concerns about the likely impact of military action upon freedom of navigation, flight safety, security of and access to civilian airfields, and the resultant disruption to commercial airline networks.

Given that over forty percent of the installed base is self-managed, and a significant portion of the fleet is in the very-light/light and mid/super-midsize categories (including six out-of-production Hawker aircraft), the potential for large numbers of banks and financiers being impacted is low. However, for those that are it would be surprising if Risk and Asset Management staff hadn’t already begun the process of considering the location, security, and technical condition of their aircraft and hard-copy records, and the suitability of their borrowers’ insurance coverage.

Conflict or no conflict, it goes without saying that the impact of all of this upon the appetite of financiers to consider future aircraft lending in Ukraine (and other European nations near Russia) is yet to be fully understood; however, it is unlikely to be particularly helpful.

In this first in a series of country-specific studies, we investigate the size and nature of the installed base, the market’s leading management companies and operators, aircraft registries, and the habitual bases of the aircraft.

A summary of the installed business jet fleet in Ukraine, January 2022.

Ionic to attend Airline Economics Growth Frontiers conference 2021

Ionic Aviation will be attending the Airline Economics Growth Frontiers conference in London (https://www.aviationnews-online.com/conferences/london/) on behalf of our friends and colleagues at AMS Aircraft Services, from 20-22 September 2021. In attendance will be over seven hundred international delegates from the commercial aviation sector, including banks, lessors, investors, technical service providers, law firms and consultants.

Not only does the event signify a welcome return to industry networking, but the areas of discussion will present delegates with an opportunity to review the state of the market and plot a way forward for the remainder of 2021 and beyond. If you are attending and would like to meet, please do contact us in advance.

We look forward to seeing you there!

Ionic Inspects Global 6000 in London

Ionic Aviation was recently instructed to conduct the physical inspection of a Bombardier Global 6000 aircraft in London, prior to the refinancing of the asset by an international aircraft finance company.

Ionic was onsite within only 48 hours of being retained, thereby demonstrating the company’s ability to respond at short notice, for its international client base, and despite the impact of the current Covid-19 pandemic.

Ionic Aviation attends UK Aviation Club

Ionic Aviation this week (March 2020) attended the most recent gathering of The Aviation Club of the UK in London.

This was the second iteration of the Club’s regular members’ lunch at its new venue, the RAC Club on Pall Mall. In a Club first, attendees listened to a remotely-delivered presentation by keynote speaker and CEO of Comair Group, Wrenelle Stander, who discussed the challenges and opportunities associated with leading one of South Africa’s leading airline groups.

Now in its twentieth year, the Aviation Club (www.aviationclub.org.uk) was founded to create a networking forum for members and a vehicle for promoting and developing all aspects of civil aviation. The Club has a membership comprising over 400 aviation professionals from airlines, airports, banks, lessors, manufacturers, regulators and the legal community.